Sustainability at Tanner Banco Digital

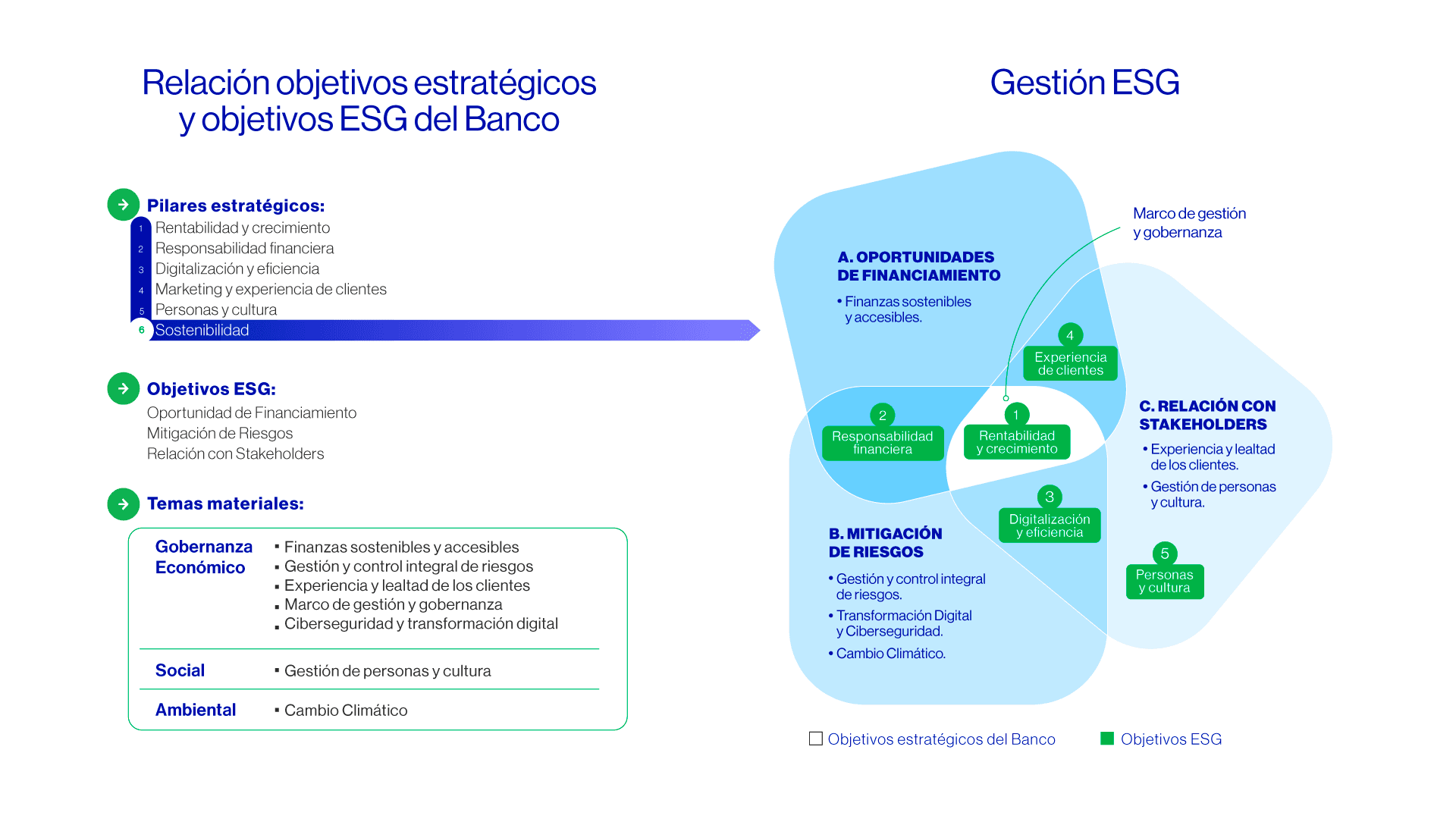

It is a transversal strategic pillar that generates value through a business model that promotes good practices in environmental, social, and corporate governance (ESG) matters.

Sustainability Pillars of Tanner Banco Digital

Our Sustainability strategy is based on five pillars that align programs and practices with our business objectives, stakeholder expectations, and the balance between economic development, social responsibility, and environmental preservation.

Materiality Analysis

From these pillars, 18 themes in different areas emerge, providing us with a guide to develop our sustainability strategy.

Check and download the infographic of our Materiality Analysis Review infographic

Principles and Commitments with our Stakeholders

Sustainable Financing at Tanner Digital Bank

Committed to a sustainable economy, we follow Tanner Group’s Sustainable Financing Framework to drive social and environmental impact, defined by the following eligible categories for funding use.

Eligible Social Categories

Micro, Small, and Medium Enterprises (MSMEs) are defined by revenue according to the MSME definition of the Chilean Internal Revenue Service (SII).

Eligible Green Categories

Clean transport: related to financing or refinancing the development, manufacturing, operation, modernization, acquisition, import, and maintenance of zero direct emissions vehicles (e.g., electric), low GHG emission vehicles and parts (e.g., hybrids), and/or components that meet the following criteria:

- Motorcycles, light, and medium vehicles must meet the threshold of 50 gCO2e/passenger-km.

- Freight vehicles (such as heavy trucks) must meet the threshold of 25 gCO2/ton-km.

Contact Us

Contact Us

Spanish

Spanish  English

English